New Delhi24 minutes ago

- Copy link

Yesterday’s big news was related to the price of gold. According to the website of India Bullion and Jewelers Association (IBJA), gold was at Rs 95,631 on last Saturday i.e. 26 April, which has now come to Rs 93,954 per 10 grams. That is, this week its price has been reduced by Rs 1,677.

At the same time, after Amul and Mother Dairy, now the milk supply organization of Uttar Pradesh, Lucknow Milk Union (Parag) has also increased the prices of milk. These new rates have come into force today i.e. from May 3.

Today’s headlines before tomorrow’s big news, which will be seen …

- The stock market will be closed today due to weekly holidays.

- There has been no change in the price of petrol and diesel.

Now read the big news of tomorrow …

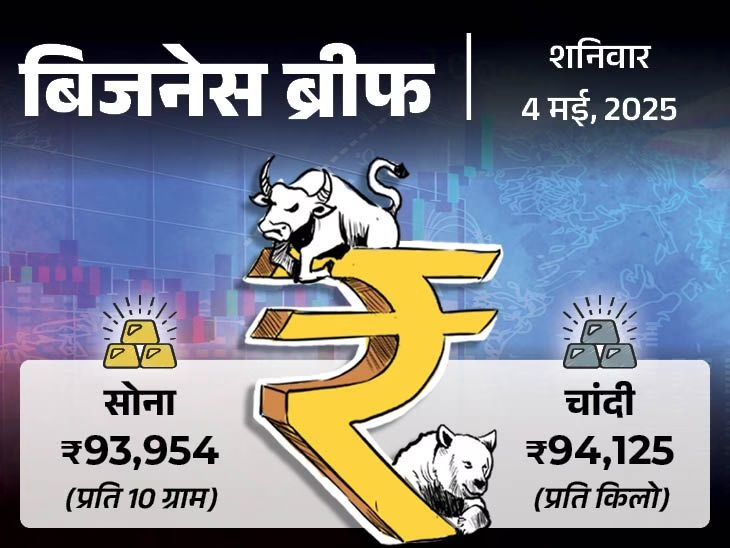

1. Gold and silver fall this week: Gold fell ₹ 1,677 to ₹ 93,954, silver is reduced by ₹ 3,559 to ₹ 94,125 kg selling

Gold and silver prices declined this week. According to the website of India Bullion and Jewelers Association (IBJA), gold was at Rs 95,631 on last Saturday i.e. 26 April, which has now come to Rs 93,954 per 10 grams. That is, this week its price has been reduced by Rs 1,677.

At the same time, when it comes to silver, it was at Rs 97,684 last Saturday, which has now come to Rs 94,125 per kg. In this way, its price has come down by Rs 3,559 this week.

Click here to read the full news …

2. After Amul, pollen also increased the price of milk: 1 rupee will be expensive, full cream and toned milk, new prices came into force from today

After Amul and Mother Dairy, now the milk supply organization of Uttar Pradesh, Lucknow Milk Union (Parag) has also increased the prices of milk. These new rates have come into force today i.e. from May 3. The company has cited the increase in cost as the reason for this. Now one liter pack of full cream milk has been increased from Rs 68 to Rs 69, while half a liter pack is increased from Rs 34 to Rs 35.

Click here to read the full news …

3. SBI’s income reached ₹ 1.44 lakh crore: The country’s largest government bank decreased profit in the fourth quarter, yet a big dividend paid

State Bank of India (SBI), the country’s largest government bank, will pay a dividend of Rs 15.90 per share. The bank gave this information on Saturday with the results of the fourth quarter of FY 2024-25.

The bank said that it has made a net profit of Rs 18,643 crore in the January-March quarter. However, it has decreased by 10% on an annual basis. The bank’s total income increased by 12.04% to Rs 1,43,876 crore in the January-March quarter.

Click here to read the full news …

4. Reliance’s market value increased by ₹ 1.65 lakh crore this week: The market cap of 7 in top-10 companies increased ₹ 2.31 lakh crore due to increase in stocks of shares

The market value of the country’s largest private sector company Reliance Industries has increased by Rs 1.65 lakh crore after this week’s business. Now the company’s market cap has been Rs 19.24 crores.

Apart from Reliance, the value of telecom company Bharti Airtel has increased by Rs 20,756 crore to Rs 10.56 lakh crore. At the same time, ICICI Bank has increased ₹ 19,382 crore, HDFC 11,515 crore and Infosys’s 10,902 crore has increased.

Click here to read the full news …

5. 2025 Tata Ultrose facelift will be launched on May 21: India’s first premium hatchback with flush door handle, new design shown in first teaser

Tata Motors has released the first teaser of its premium hatchback car Tata Ultrose facelift. The company is preparing to launch it on May 21 with new design and advance features. This will be the first hatchback car in India, with flush door handles.

Its exterior design is revealed in the teaser. The car has more modern design elements than before. This will be the first facelift update model of the ultrose. Apart from flush door handles, it will get Ledene LED headlamps, 3D front grille and Infinity LED tail lamps.

Click here to read the full news …

Now read the news of your need

Invest in SBI’s ‘Every Home Lakhpati Scheme’: In this, you will get ₹ 1 lakh on depositing ₹ 593 every month, see special things related to this

State Bank of India i.e. SBI is running a special recruitment deposit (RD) scheme ‘Har Ghar Lakhpati’. Under this scheme, you can arrange one lakh or more rupees by depositing small amounts every month. In this, a maximum of 6.75% interest is being given to ordinary citizens and a maximum of 7.25% annual interest to senior citizens (senior citizens).

Recurring deposits or RD can help you in large savings. You can use it like a piggy bank. Meaning you keep putting a certain amount in it when the salary comes every month and if it is matured, you will have a big amount in your hand. The maturity period of every house is usually from 3 years to 10 years. That is, you can invest from 3 years to 10 years.

Click here to read the full news …

Tomorrow, see who should be the top-10 richest in the world…

The market was closed yesterday then Friday Know the condition of stock market and gold and silver …

Know the latest price of petrol-diesel and gas cylinders …