- Hindi news

- Business

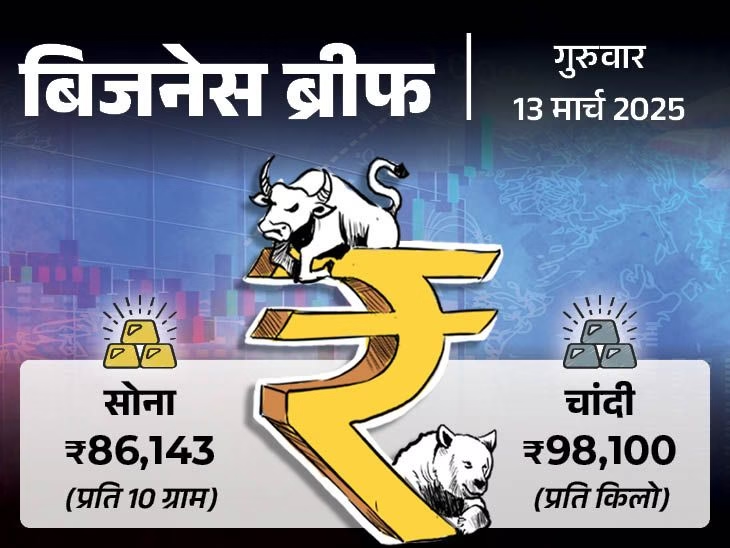

- Business news update; Share Market, Gold Silver Rate, Petrol Diesel, Retail Inflation, Spacex Jio Airtel

New Delhi7 minutes ago

- Copy link

Yesterday’s big news was related to retail inflation. Retail inflation has come down to 3.61% in February. This is a 7 -month low of inflation. At the same time, after Airtel, now Jio has also made a deal with Musk’s company Star Link to provide satellite internet.

Today’s headlines before tomorrow’s big news, which will be seen …

- The stock market may see a decline today.

- There has been no change in the price of petrol and diesel.

Now read the big news of tomorrow …

1. Retail inflation came down to 3.61% in February: the lowest in 7 months, vegetables and pulses cheaper; Inflation was at 4.31% in January

Retail inflation has come down to 3.61% in February due to cheap pulses and vegetables. This is a 7 -month low of inflation. Inflation was at 3.54% in July 2024. In January 2025, inflation was 4.31%. The Ministry of Statistics released inflation figures on 12 March.

About 50% contribution to inflation baskets is food and drink. Its inflation has come down from 5.97% to 3.75% on a month-month basis. At the same time, rural inflation has come down from 4.59% to 3.79% and urban inflation has come down from 3.87% to 3.32%.

Click here to read the full news ..

2. After Airtel, Jio’s Space-X Deal: Satellite will get internet in the country, Musk’s company has the largest network in the world

After Airtel, now Reliance Jio, the country’s largest telecom service provider, has also tied up with Ilon Musk’s company Star Link to provide satellite internet.

On Tuesday (March 11), telecom company Bharti Airtel tied up with the American company. Airtel has informed about this in stock exchange filing yesterday.

Click here to read the full news ..

3. Investment of ₹ 29,303 crore in equity mutual funds in February: 26.1% less than last month; Investment in all schemes decreased by ₹ 1.47 lakh crore

In February 2025, the Equity Mutual Fund has invested Rs 29,303 crore, which is 26.1% less than in January 2025. In January, Equity Mutual Funds had an investment of Rs 39,687 crore crore.

According to data released by the Association of Mutual Funds in India (AMFI), the total inflow in all types of mutual fund schemes has reduced by Rs 1.47 lakh crore. A total of Rs 40,063 crore has come to net inflow in February. The total net inflow in the last month was Rs 1.88 lakh crore.

Click here to read the full news ..

4. Indian economy will increase at the rate of 6.5% in FY26: Capital Expenditure, Tax and Support to Growth from Interest Rate cuts; There will be stability in banking sector

India’s economy will grow at a rate of more than 6.5% in FY 2025-26. This is more than an estimate of 6.3% of the current financial year i.e. 2024-25. Moody’s Ratings gave this information in his report on Wednesday. According to the report, the government will spend more capital.

Apart from this, consumption will increase due to tax cuts and reduction in interest rate, which will give support to growth. During this time there will be stability in the banking sector. The operating environment of Indian banks will remain a favorite in the next financial year. But after the necessary improvement in the last year, there will be a slight decline in their asset quality.

Click here to read the full news ..

5. Boat will file DRHP near SEBI next week: Plan to raise ₹ 2,000 crore from IPO, the company had earlier applied in 2022

The consumer electronics brand boat may file draft red hering prospectus (DRHP) near SEBI for its Initial Public Offering ie IPO next week. According to reports, the company is planning to raise Rs 2,000 crore through this IPO.

Sources in the company have told Business Today TV that the boat expects SEBI approval for the IPO by the second quarter of FY 26. The exact size of the IPO will be told only in DRHP. Sources estimate that the total size of the IPO can be Rs 2,000 crore.

Click here to read the full news ..

Now read the news of your need …

Tax exemption and better returns in Senior Citizens Savings Scheme: 8.2% interest in it, know special things related to this scheme

The last month of FY 2024-25 i.e. March has started. This month you have to settle many important tasks. One of these works is tax saving investment for FY 2024-27. You have to do this investment by 31 March 2024.

If you are senior citizens and want to save tax with safe investment, then you can invest in post office Senior Citizens Savings Scheme account (SCSS). This scheme is currently being paid 8.20% annually.

Click here to read the full news ..

Tomorrow, see who should be the top-10 richest in the world…

Know the condition of tomorrow’s stock market and gold and silver …

Know the latest price of petrol-diesel and gas cylinders …