- Hindi news

- Business

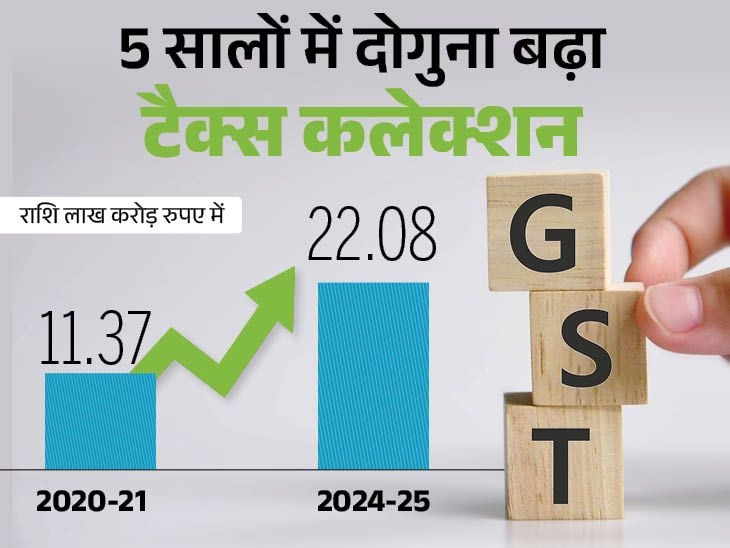

- GST collections double in 5 years to record ₹ 22 Trillion in FY25, Monthly Average Hits ₹ 1.84 Trillion

New Delhi29 minutes ago

- Copy link

In FY 2024-25, gross GST collection has reached Rs 22.08 lakh crore

Today, 8 years have been completed in GST implemented in the country. GST was implemented in the country on 1 July 2017. During this time, tax collection data has set a new record. In FY 2024-25, the gross GST collection has reached Rs 22.08 lakh crore, which was only 11.37 lakh crore in 2020-21 5 years ago.

That is, tax collection has almost doubled in 5 years. The average GST collection was Rs 1.84 lakh crore every month in 2024-25. It was 95 thousand crore rupees in 2020-21 5 years ago.

The number of taxpayers also increased more than doubled

At the time of implementation of GST, the number of registered taxpayers in 2017 was 65 lakhs, which has now increased to more than 1.51 crore. This has also strengthened the tax base of the government.

The government says that after the implementation of GST, there has been a tremendous increase in both tax collection and tax base. This has strengthened the country’s fiscal position and the tax system has become more transparent and easy.

The biggest tax collection in history in April 2025

The government raised Rs 2.37 lakh crore from Goods and Services Tax (GST) in April 2025. It increased by 12.6% on an annual basis. This is a record of GST collection.

Earlier, the record of the highest GST collection was set in April 2024. The government had then raised 2.10 lakh crore rupees.

Economy’s health shows GST collection

GST collection is an important indicator of Economic Health. Higher collections indicate strong consumer expenses, industrial activity and effective tax compliance.

Businesses often clear the transactions from March to the end of the year in April, increasing tax filings and collections. KPMG’s National Head Abhishek Jain said that the highest GST collection so far reflects a strong domestic economy.

GST was implemented in 2017

The government implemented GST across the country on 1 July 2017. After this, 17 taxes and 13 centers of the central and state governments were removed. On the completion of 7 years of GST, the Finance Ministry posted with the achievements achieved during the last seven years.

GST is an indirect tax. It was implemented in 2017 to replace many types of indirect tax like VAT, service tax, purchase tax, excise duty. The GST has four slabs of 5, 12, 18 and 28%.

GST is divided into four parts:

- CGST (Central GST): It is collected by the central government.

- SGST (State GST): It is collected by state governments.

- IGST (Integrated GST): Applied to interstate transactions and imports, divided between the central and state governments.

- Cess: Additional fees levied on specific goods (eg, luxury items, tobacco) to raise funds for specific purpose.