New Delhi2 hours ago

- Copy link

In March, the government raised Rs 1.96 lakh crore from GST.

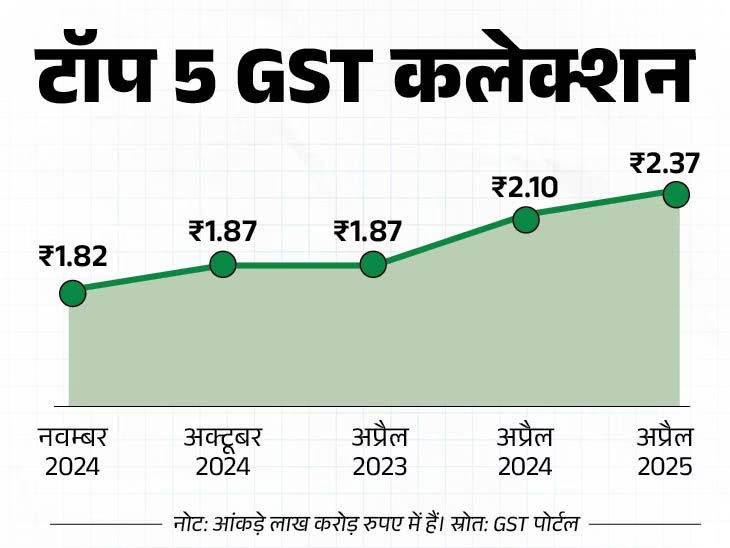

The government raised Rs 2.37 lakh crore from Goods and Services Tax (GST) in April 2025. It has increased by 12.6% on an annual basis. This is a record of GST collection.

Earlier, the record of the highest GST collection was set in April 2024. The government had then raised 2.10 lakh crore rupees. On Thursday, May 1, the government released GST data.

Domestic transaction raised 1.90 lakh crores

During this period, the government has charged 1.90 lakh crore tax from domestic transactions. It has grown 10.7% on an annual basis. At the same time, 46,913 crore GST government has raised through imports. It has increased by 20.8% in a year.

- In April, the government refunded a total amount of Rs 27,341 crore.

- After the refund, the NET GST collection for July was Rs 2.09 lakh crore.

- This is 9.1% higher than the same period of previous year (July 2023).

Economy’s health shows GST collection

GST collection is an important indicator of Economic Health. Higher collections indicate strong consumer expenses, industrial activity and effective tax compliance.

Businesses often clear the transactions from March to the end of the year in April, increasing tax filings and collections. KPMG’s National Head Abhishek Jain said that the highest GST collection so far reflects a strong domestic economy.

GST was implemented in 2017

The government implemented GST across the country on 1 July 2017. After this, 17 taxes and 13 centers of the central and state governments were removed. On the completion of 7 years of GST, the Finance Ministry posted with the achievements achieved during the last seven years.

GST is an indirect tax. It was implemented in 2017 to replace many types of indirect tax like VAT, service tax, purchase tax, excise duty. The GST has four slabs of 5, 12, 18 and 28%.

GST is divided into four parts:

- CGST (Central GST): It is collected by the central government.

- SGST (State GST): It is collected by state governments.

- IGST (Integrated GST): Applied to interstate transactions and imports, divided between the central and state governments.

- Cess: Additional fees levied on specific goods (eg, luxury items, tobacco) to raise funds for specific purpose.

,