Mumbai3 minutes ago

- Copy link

State Bank of India (SBI), the country’s largest government bank, has received a net profit of Rs 18,643 crore in the fourth quarter of FY 2024-25.

It has decreased by 10% on an annual basis. A year ago, that is, the bank made a profit of Rs 20,698 crore in the fourth quarter of FY 2023-24.

SBI’s total income increased by 12.04%

The bank’s total income increased by 12.04% to Rs 1,43,876 crore in the January-March quarter. It was Rs 1,28,412 crore in the same quarter of last year. At the same time, it was 11.99% more than the previous quarter.

Net interest income increased by 8%

SBI’s net interest income (NII) i.e. net interest income increased by 8% to Rs 1,19,666 crore in the January-March quarter. It was Rs 1,11,043 crore in the same quarter of last year. It was Rs 1,17,427 crore in the October-December quarter. It has increased by 2% on a quarterly basis.

Bank will give davidand Rs 15.90 per share

With the results of the fourth quarter, the State Bank has announced a dividend of Rs 15.90 per share to its shareholders. Companies give some part to their shareholders from their profits, it is called dividend or dividend.

What is standalone and consolidated?

Companies’ results come in two parts- Standalone and Consolidated. Standalone shows only one segment or financial performance of the unit. Whereas, the entire company reports are given in the consolidated or consolidated financial report.

The amount not received gets NPA

If the bank gives a loan or advance, if it does not recover on time, then the bank declares that amount as NPA i.e. non-performing asset. In general, in the event of not getting returns for 90 days, the bank puts the loan or advance amount in the list of NPA. This means that the bank is not getting any benefit from this amount at the moment.

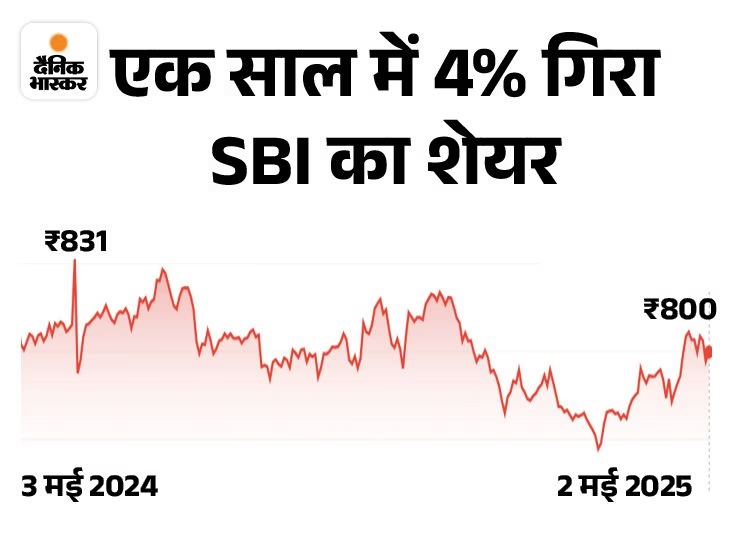

This year SBI shares did not give any returns

SBI released the results of the January-March quarter today i.e. on 3 May 2025. The bank’s stock climbed 1.41% to close at Rs 799.80 on the previous business day i.e. Friday, May 2.

SBI shares have given a return of 2.64% in the last one month and 0.83% from this year i.e. January 1. At the same time, it has fallen 3.62% in the last 6 months and 3.81% in a year. The state bank’s market cap is Rs 7.13 lakh crore.

On Friday, May 2, the bank’s stock climbed 1.41% to close at Rs 799.80.

SBI is the largest government bank in the country

SBI is the largest government bank in the state State Bank of India. The government has 57.59% stake in SBI. It was established on 1 July 1955. The bank is headquartered in Mumbai. At the same time, the bank has more than 22,500 branches and more than 50 crore customers. The bank works in 29 countries of the world. It has 241 branches outside India.