Mumbai22 minutes ago

- Copy link

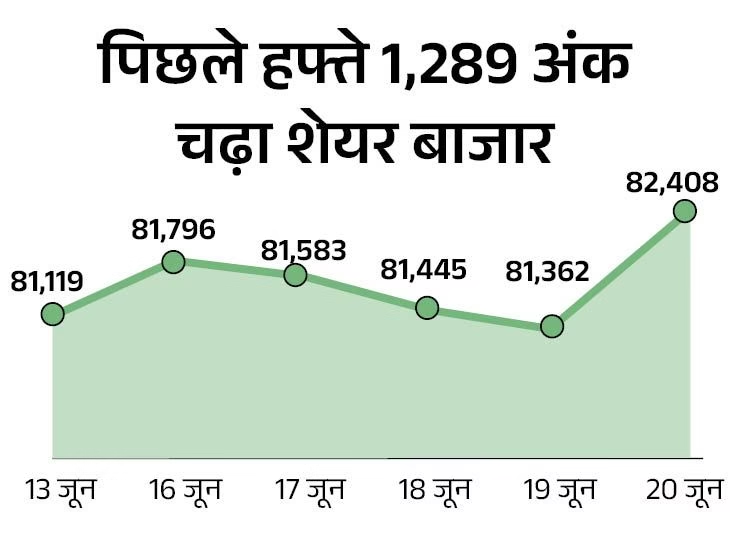

On the second trading day of the week today i.e. on Tuesday, June 24, the Sensex climbed around 900 points to 82,800. The Nifty also has a gain of about 300 points, it is at a level of 25,250.

The Sensex has a rise in 29 out of 30 shares. 14 shares including Adani Ports, Bajaj Finserv, Asian Paints are up to 3% up. There is a slight decline in the NTPC.

46 of the 50 Nifty shares are rose. All the sectors of NSE are above. Nifty PSU banking 2.03%, realty 1.40%, IT 1.14%, oil and gas are 0.7%and metal-auto 1.3%.

4 reasons for market boom

- Ceasefire news in Iran-Israel War: US President Donald Trump claimed a ceasefire between Iran and Israel at 3:30 am on Tuesday. This has increased the expectation of low political stress to decrease.

- Crude oil prices fall: Today crude oil prices fell by 2% to $ 67.13 per barrel. Brent crude price has fallen by 1.8% to 67.17 per barrel. Oil prices increased by 10% after the struggle started.

- Shopping for foreign and domestic investors: Foreign investors’ support is strengthening the market. Fiis on Monday made a net 5,591.77 crore rupees in domestic equity.

- RBI’s Infrastructure Financing Rules relaxed: RBI made provisioning rules easier for banks and infrastructure projects for NBFC, which led to more funds available with banks. This decision rose banking shares and the market got support.

Asian markets rose by 2.5%, Americans also climbed

- In Asian markets, Japan’s Nikkei is trading at a level of 38,769 up to 38,769 and Korea’s Kospi is trading at 3,089.

- Hong Kong’s Hangseng index is at 2.02% to 24,168. At the same time, while China’s Shanghai Composite is trading at 3,414 above 0.96%.

- On June 23, the US Dow Jones climbed 0.89% to close at 42,582. At the same time, Nasdaq Composite climbed up to 19,631 above 0.94% and climbed S&P 0.96% to 6,025.

Foreign investors bought shares worth 5,592 crore on 23 June

- On 23 June, Foreign Investors (FIIs) bought shares worth Rs 5,591.77 crore in the cash segment. At the same time, domestic investors (DIIs) sold Rs 1,874.38 crore.

- So far, foreign investors have purchased ₹ 9,488.98 crore in the cash segment and ₹ 54,911.92 crore in the cash segment.

- Net purchases of foreign investors in May stood at Rs 11,773.25 crore. At the same time, domestic investors also purchased a net of ₹ 67,642.34 crore in a month.

Three IPOs are getting open from today

A total of 6 main-board IPOs will open this week. See the list …

Market dropped more than 500 points on Monday

The Sensex fell 511 points to close at 81,897 on the first trading day of the week. The Nifty also declined by 141 points, it reached 24,972.

9 out of 30 shares of Sensex declined and 21 declined. HCL Tech, Infosys and Larsen & Toubro shares fell to 2.3%. Trent and BEL rose by 3.4%.

35 out of 50 shares of Nifty closed down. The IT index of NSE declined by 1.48%, auto 0.92% and FMCG by 0.74%. Media rose by 4.39%. Metal and consumer durables also climbed and closed.

,

Read this news related to the market too …

25 June can look important for the market, reversal: Learn from experts special-time and level for trading; 5 factors will decide the market move

The week starting from June 23 is going to be important for the stock market. Israel-Iran will decide the move from war and purchase and sale of foreign investors to technical factors.

Apart from this, wealth-verse analytics have given certain time and levels in its Weekly Market Outlook report, which can prove beneficial for traders.

Click here to read the full news …

This week the market will open 17 new IPOs: 6 of these 6 mainboards IPO; Minimum can start investing from ₹ 14,800

A total of 17 new IPOs, including 6 mainboards, will open in the stock market this week. This includes companies from different sectors such as finance, infra, industrial, food, tech and james-jewelery.

According to brokerage firms, the IPO performance listed in recent times has strengthened investors’ confidence.

Liquidity has increased in the market, participation of retail and institutional investors is increasing. Due to this, many companies are bringing IPO again in the market.

Click here to read the full news …