New Delhi3 minutes ago

- Copy link

To promote Unified Payment Interface (UPI), the Union Cabinet has extended the incentive scheme for one year today (March 19). This scheme will continue till 31 March 2026 and it will cost around Rs 1,500 crore.

In this scheme, small shopkeepers will get 0.15% incentives for transacting Person to Merchant (P2M) up to Rs 2,000 through RuPay Debit Card and BHIM-UPI.

Person to merchant UPI transaction means UPI transaction is done between the businessman and the customer. This scheme is applicable from 1 April 2021. Promoting RuPay Debit Card will have a direct impact on global payment company visas and master cards.

Shopkeeper will get ₹ 1.5 incentive by transferring ₹ 1000 of the customer If the customer buys goods worth Rs 1000 and pays from UPI, then the shopkeeper will get an incentive of Rs 1.5. At the same time, banks will also get incentives. The government will give 80% of the claims of banks immediately.

The bank will get 20% of the remaining amount to banks when the technical fault of the bank is less than 0.75%. The bank’s system uptime will be more than 99.5%.

Government will give percentage of transaction value Under the scheme, the government gives banks a percentage of transactions done through the Rupay and BHIM-UPI system. Aquarring bank means all banks or financial institutions that process credit or debit card payment for traders.

20,000 crore transaction target The government is working to promote digital payment. After the cabinet meeting, Union Minister Ashwini Vaishnav said that the government aims to complete 20,000 crore transactions in FY 2025-26. Also, UPI has to spread to small towns and villages.

Previously, merchant discount rate on Rupay Debit Card and BHIM-UPI transactions was zero. Now, with this new incentive scheme, shopkeepers will be promoted to get UPI payment.

He said that, ‘UPI payment is easy, safe and fast payment service for shopkeepers. Also, money without any extra charge comes directly into the bank account.

NCPI operates UPI RTGS and NEFT payment system operations in India are with RBI. The National Payment Corporation of India (NPCI) operates systems like IMPS, Rupay, UPI. The government had a zero-charge framework mandator for UPI transactions from 1 January 2020.

How does UPI work? For UPI service, you have to prepare a virtual payment address. After this it will have to link to the bank account. After this, there is no need to remember your bank account number, bank name or IFSC code etc. The payment bus processes the payment request according to your mobile number.

If you have its UPI ID (e-mail ID, mobile number or Aadhaar number), then you can easily send money through your smartphone. Net banking, credit or debit card will not be required not only for money but also for utility bill payment, online shopping, shopping etc. You can do all this work with unified payment interface system.

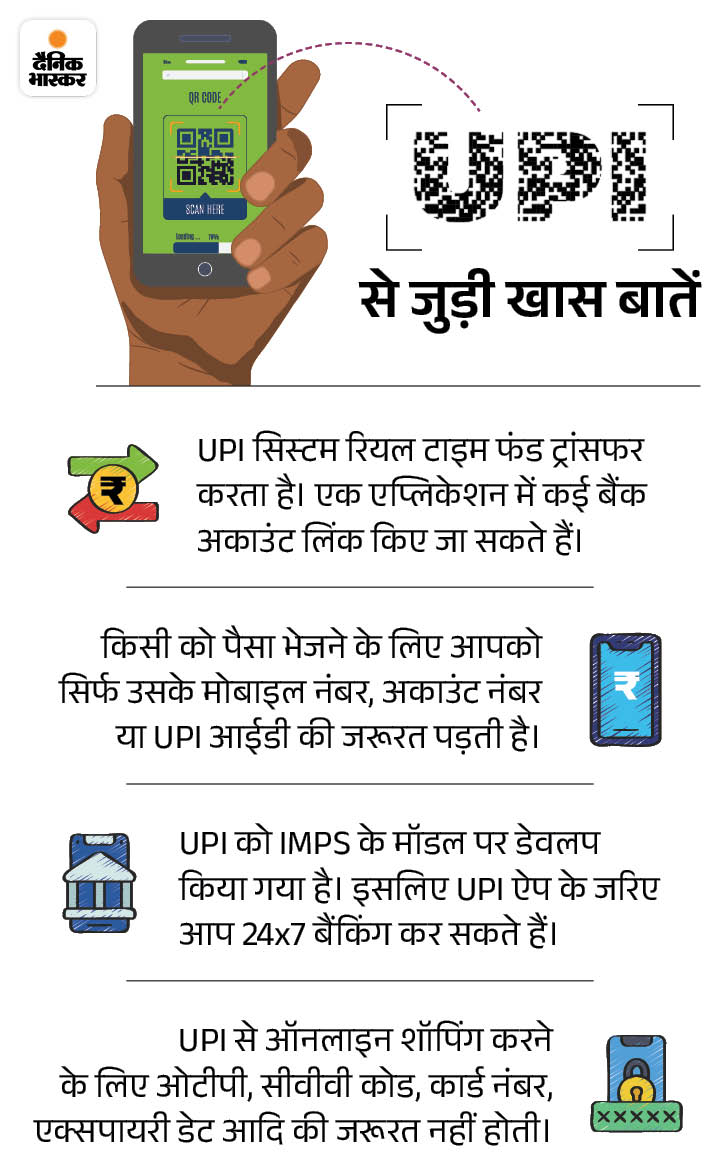

Special things related to UPI

- UPI System Transfers Real Time Fund

- For sending money to someone, you will only need its UPI ID (a virtual identity like email address, mobile number, Aadhaar number).

- With the UPI ID, you will not need to get information about the beneficiary’s name, account number, bank etc. to transfer funds. The amount is transferred using the IFSC code and mobile number.

- The UPI is developed on the model of IMPS. That is why you can do 24*7 banking with this app.

- OTP, CVV code, card number, expiry date etc. will not be required to shop online from UPI.

- A mobile application can be transacted with several bank accounts.