Mumbai2 minutes ago

- Copy link

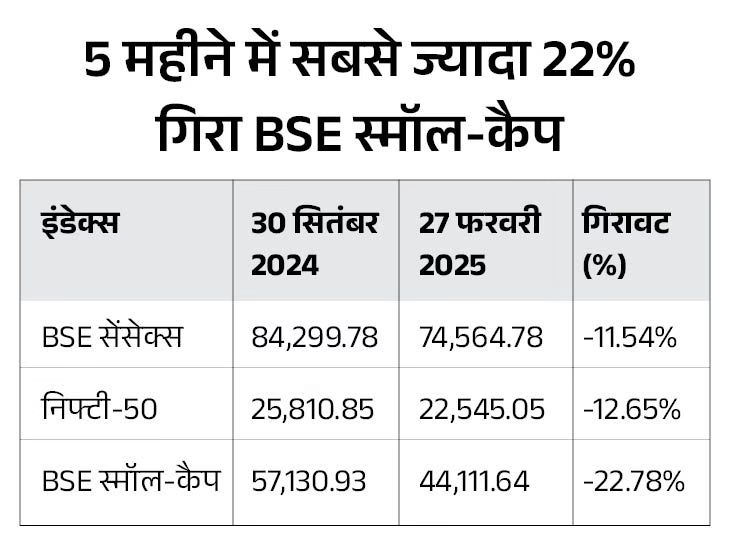

Since October 2024, the Nifty has closed down every month. It has fallen 12% in 5 months. After 1996, that is, for the first time in 30 years, the market has declined five consecutive months.

Earlier in 1996, between July to November, the market had a 5 -consecutive decline decline. The Nifty 50 index fell 26% during these 5 months. That is, this is the second time in history that the market has been recorded 5 consecutive months.

1. How much has the wealth of investors decreased in the last 5 months?

On 30 September 2024, the market cap of companies listed on Bombay Stock Exchange i.e. BSE was Rs 474 lakh crore, which declined to Rs 385 lakh crore on February 28. That is, in 5 months, the wealth of investors has come down by Rs 89 lakh crore.

2. What are the reasons for the steady decline in the stock market?

- Constant selling of foreign investors: Foreign investors withdrew Rs 3.11 lakh crore from the Indian market in only five months (October 2024-February 2025). Investors have done these selling due to weak results of companies in the September and December quarter. In addition, the hopes of improving the Chinese economy attracted investors. Investors see the shares of Chinese companies more cheaper than the shares of Indian companies.

- Inflation is still a cause of great concern: Retail inflation rose to 6.21% in October 2024 due to expensive food items. It was the highest level of 14 months of inflation. However, in January 2025, retail inflation had come down to 5 months low of 4.31% due to cheap food items. This decrease is not enough to restore the trust of investors.

- The slow pace of growth of economy: The Indian economy has slowed down in recent months. According to an estimate by the National Statistics Office (NSO), India’s growth rate in FY 2024-25 has been estimated at 6.4%, which is a 4-year low. The GDP growth rate was 8.2% in the last financial year 2023-24. It was 6.7% in the first quarter of FY 2024-25. The number fell to 5.4% in the second quarter. The growth of the manufacturing sector slowed down the growth.

- Investors worried about Donald Trump’s trade policy: There is uncertainty in the market due to the threat of US President Donald Trump to put reciperook tariffs (like Tit) on other countries including India. Trump said in the past, ‘We will put reciperook tariffs. Whether it is any country- India or China, we will do it as much as they charge on us. We want equal in business. 25% tariff on Canada and Mexico is going to be implemented from March 4.

3. What should investors do in this decline?

Devina Mehra, MD of Asset Management firm First Global, says- Academic Studies made from America to Europe show that whenever people are afraid or worried about investing in the market, then the market has given more returns than average. That is, whenever you think the shares should be sold, SIP should be shut down and should leave the market at that time the best time to invest in the market.

It is understood by two examples:

- On 21 January 2008, the Sensex fell nearly 1400 points in a single day. By the end of 2008, the Sensex fell from 20,465 points to 9716 points. In September 2010, the Sensex again crossed the 20,000 points.

- In the year 2020, the Sensex fell from 42,273 points to 28,288 points in a single week due to the corona epidemic. From April 2020, it saw recovery and the Sensex had reached 47,751 levels by the end of the year.

That is, whenever there has been a decline in the market, there is also a rapid recovery. In such a situation, investors who are already invested should remain in their investment. At the same time, those who want to invest new can invest a little bit.

4. Has the global market also declined?

- The US market Dow Jones was at 42,330 on 30 September 2024. It closed at 43,240 on 27 February 2025. That is, it has climbed 910 points (2.14%) in 5 months. However, Dow Jones made an all -time high of 45,014 on 4 December 2024. That is, the market is 1774 points below the high.

- China’s market Shanghai Composite was at 3336 level on 30 September 2024. On 27 February 2025, it closed at 3388 levels. That is, it has climbed 52 points (1.55%) in 5 months. At the same time, Hong Kong’s Hangseng index was at 21,133 on 30 September. It closed at 23718 levels on 27 February. That is, it has climbed 2585 points (12.23%).

- Germany’s stock market dax was at 19324 on 30 September 2024. It closed at 22378 on 27 February 2025. That is, it has climbed 3024 points (15.8%) in 5 months. The FTSE 100 index was at 8,236 levels on 30 September. On 27 February it closed at 8,756 levels. That is, it has climbed 520 points (6.31%).

5. How many months of Indian market has fallen in history?

The Nifty 50 index was launched in July 1990. The data shows that the Nifty 50 recorded its worst monthly performance in 1995. The Nifty had then dropped for eight consecutive months from September 1995 to April 1996. During this period, a decline of more than 31% was recorded.